tax loss harvesting limit

Which cost basis method for crypto tax loss harvesting13. Look at your brokerage statements and see which investments are showing a loss.

Tax Loss Harvesting 2022 John Hancock Investment Mgmt

Before the end of the year she notices another position with an unrealized loss of 1500.

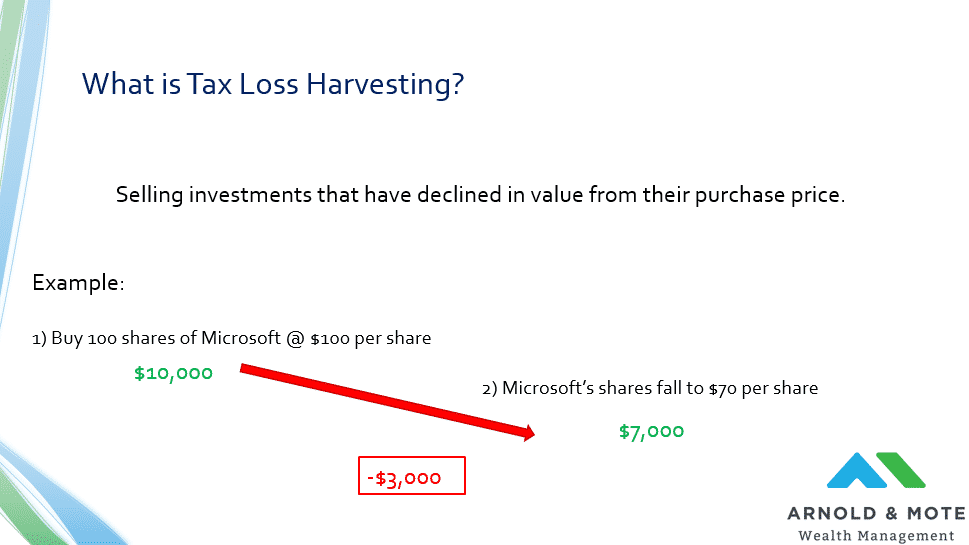

. Example of a Crypto Tax Loss Harvesting Scenario. To max out your taxable loss youll need to find investments where youve lost at least 9000. Suppose you bought 2 Bitcoins for 5000 and 5 Ethereum for 9000 in 2019.

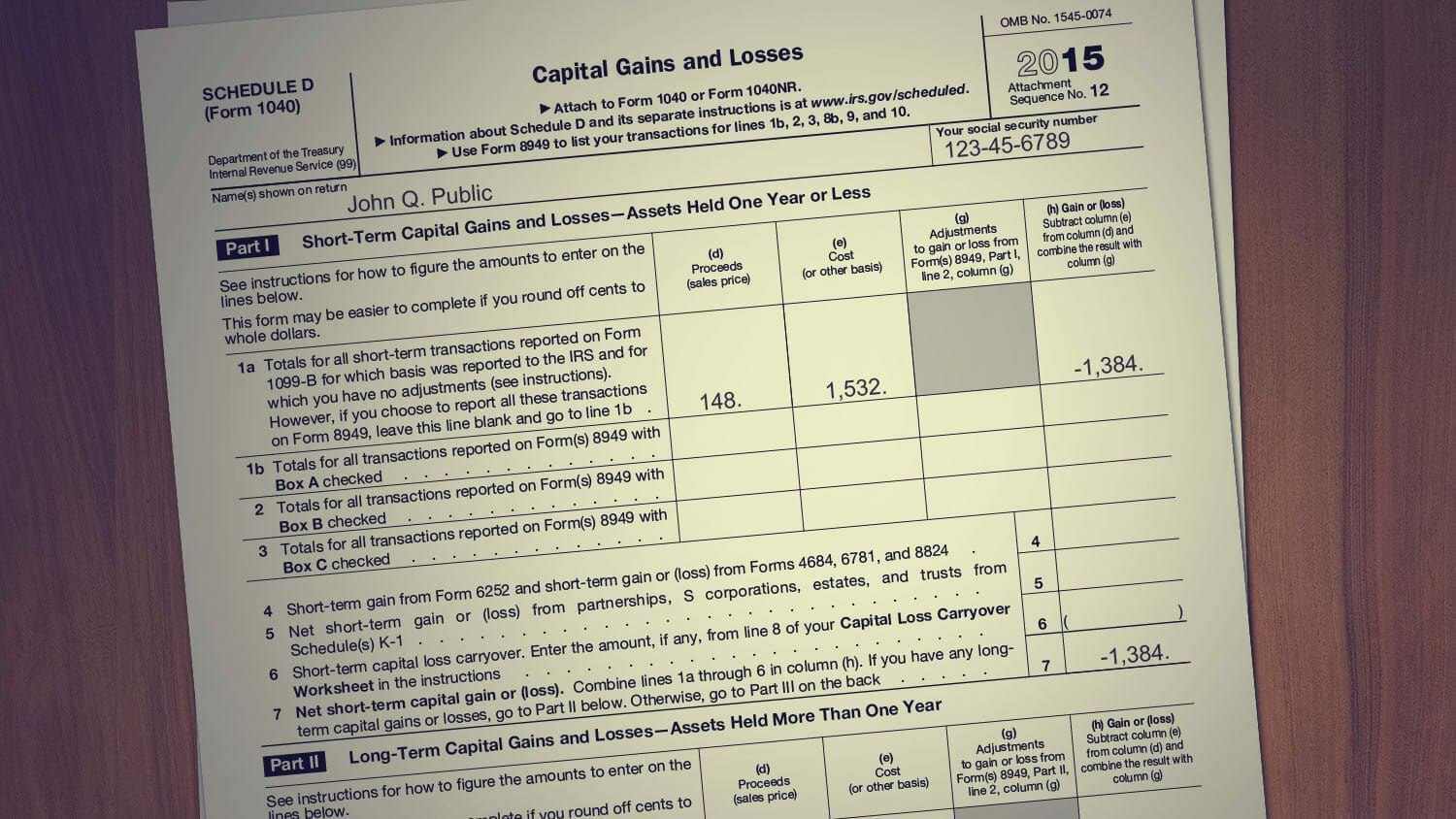

Stocks you hold more than a year are long-term stocks. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct.

However there are limits to the amount of taxes on ordinary income that can be. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Tax loss harvesting is a strategy that can help you potentially reduce your capital gains tax liability if you sell an asset for profit such as property or a business.

Two years later you sell the 2 BTC for 8000. By harvesting that loss she can now offset those 2000 in gains with it so her short. Tax Loss Carryforward.

Because you lost 5000 more than you gained 25000 20000 you can reduce your ordinary income by 3000 potentially lowering your tax liability an additional. If you lose money on these you count this as a long-term investment loss tax deduction. Currently the amount of excess losses you can claim as a deduction is.

As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years. 3000 per year for individual filers or married.

You can write off up to 3000. What are the benefits of crypto tax loss harvesting11. Is there a limit to crypto tax loss harvesting12.

Turning Losses Into Tax Advantages

Using Tax Loss Harvesting To Turn Capital Losses Into Tax Breaks M1

Rate Moves Provide Big Fixed Income Tax Loss Harvesting Opportunities

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Tax Loss Harvesting How To Make The Most Out Of Market Volatility Warren Street Wealth Advisors

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Tax Loss Harvesting Guide 2022 Beat Capital Gains

Tax Loss Harvesting Partners Physician Finance Basics

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Turn Investment Losses Into Tax Breaks Nerdwallet

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reduce Taxes With Tax Loss Harvesting

Tax Loss Harvesting And Wash Sale Rules

5 Situations To Consider Tax Loss Harvesting Turbotax Tax Tips Videos

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger